Business Day To Day

Business Solutions

Islamic Banking

Promotions

Digital Services

Help & Support

Solutions

Trade Finance

Financing

Insurance / Takaful

More Services

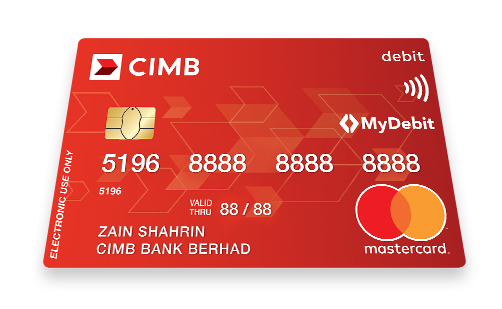

Debit Card

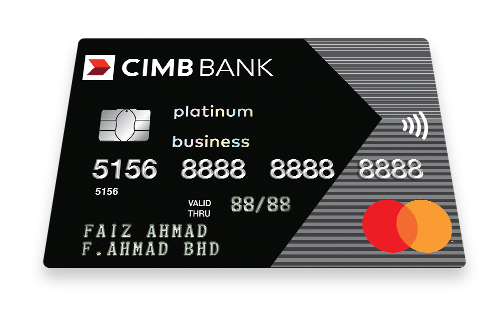

Credit Card

Sustainability-Linked Financing (SLF)

Looking to start and progress on your sustainability journey with small steps but big impact? Look no further with Sustainability-Linked Financing (SLF) and get rewarded in the form of rebates on your financing!

Valid until 31st Dec 2025

Quicklinks

Back

Business

Group

Our Initiatives

Back

Back

Cards

Debit Card

Credit Card

Cash Management

Treasury

Solutions

Sustainability-Linked Financing (SLF)

Looking to start and progress on your sustainability journey with small steps but big impact? Look no further with Sustainability-Linked Financing (SLF) and get rewarded in the form of rebates on your financing!

Valid until 31st Dec 2025

Trade Finance

Financing

Insurance / Takaful

More Services

Islamic Banking Overview

Latest Promotions

CIMB Biz

BizChannel@CIMB

Corporate Cards Online

Apply For

Retrieve Saved Application-i

Customer Help Centre

Rates & Charges

Calculators

Security & Fraud

You're viewing:

Business Banking

Other Sites

Business Day To Day

Business Solutions

Solutions

Trade Finance

Financing

Insurance / Takaful

More Services

Islamic Banking

Promotions

Digital Services

Help & Support

Quicklinks

MY

-

EN