Business Day To Day

Business Solutions

Islamic Banking

Promotions

Digital Services

Help & Support

Solutions

Trade Finance

Financing

Insurance / Takaful

More Services

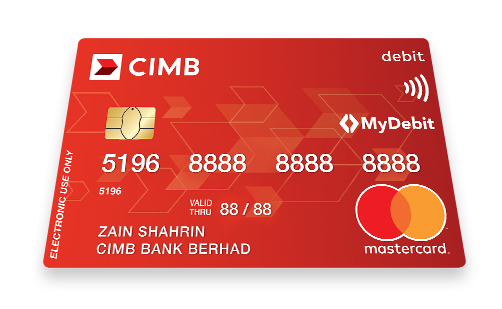

Debit Card

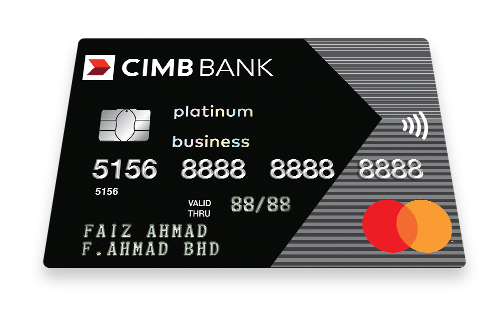

Credit Card

Quicklinks

Back

Business

Group

Our Initiatives

Back

Back

Deposits & Investments

Cards

Debit Card

Credit Card

Cash Management

Treasury

Solutions

Trade Finance

Financing

Insurance / Takaful

More Services

Islamic Banking Overview

Latest Promotions

OCTO Biz

BizChannel@CIMB

Corporate Cards Online

Apply For

Retrieve Saved Application-i

Customer Help Centre

Locate Us

Rates & Charges

Calculators

Security & Fraud

You're viewing:

Business Banking

Other Sites

Business Day To Day

Business Solutions

Solutions

Trade Finance

Financing

Insurance / Takaful

More Services

Islamic Banking

Promotions

Digital Services

Help & Support

Quicklinks

MY

-

EN