Day To Day Banking

Islamic Banking

Wealth Management

Deals & Promotions

Digital Services

Help & Support

Accounts

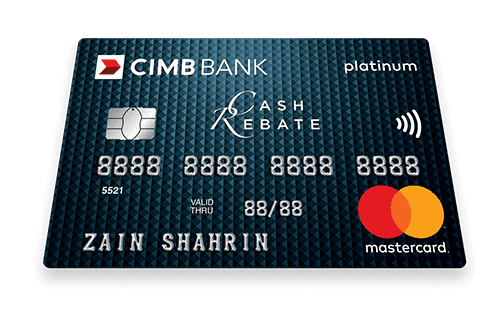

Cards

Financing

More Services

Investments

Insurance/Takaful

Credit Cards & Services

Investment Products

Riuh Durian Runtuh 2025 Campaign

Open a CIMB DURIAN-i Account, deposit & stand to win over 10,000 prizes, including all-expenses-paid trips to Iceland, Maldives, and more! Earn more entries now. T&C.

Valid until 31st Dec 2025

Cash Plus Personal Loan

Personal loan in an instant — Loan for all your personal needs. Get instant loan approval from 4.38% p.a. Apply now. Manage your finances better with rates from 4.38% p.a. Zero fees with instant approval.

Riuh Durian Runtuh 2025 Campaign

Open a CIMB DURIAN-i Account, deposit & stand to win over 10,000 prizes, including all-expenses-paid trips to Iceland, Maldives, and more! Earn more entries now. T&C.

Valid until 31st Dec 2025

Komuniti

CIMB Kita Bagi Jadi Komuniti is our platform dedicated to economic empowerment, education, and enabling communities to thrive.

Quicklinks

Back

Business

Group

Our Initiatives

Back

Back

Accounts

Riuh Durian Runtuh 2025 Campaign

Open a CIMB DURIAN-i Account, deposit & stand to win over 10,000 prizes, including all-expenses-paid trips to Iceland, Maldives, and more! Earn more entries now. T&C.

Valid until 31st Dec 2025

Cards

Credit Cards & Services

Financing

Cash Plus Personal Loan

Personal loan in an instant — Loan for all your personal needs. Get instant loan approval from 4.38% p.a. Apply now. Manage your finances better with rates from 4.38% p.a. Zero fees with instant approval.

Remittance

Currency Exchange

Sustainability at CIMB

CIMB@Work

More Services

Islamic Banking Overview

Islamic Wealth Management

More Services

Investments

Investment Products

Insurance/Takaful

Latest Promotions

Riuh Durian Runtuh 2025 Campaign

Open a CIMB DURIAN-i Account, deposit & stand to win over 10,000 prizes, including all-expenses-paid trips to Iceland, Maldives, and more! Earn more entries now. T&C.

Valid until 31st Dec 2025

CIMB Deals

Kita Bagi Jadi

Komuniti

CIMB Kita Bagi Jadi Komuniti is our platform dedicated to economic empowerment, education, and enabling communities to thrive.

CIMB OCTO App

CIMB Clicks

Apply for Products

DuitNow QR

Personalised For You

Customer Help Centre

Locate Us

Rates & Charges

Calculators

Security & Fraud

Extra Care by CIMB

You're viewing:

Personal Banking

Other Sites

Day To Day Banking

Accounts

Cards

Financing

More Services

Islamic Banking

Wealth Management

Investments

Insurance/Takaful

Deals & Promotions

Digital Services

Help & Support

Quicklinks

MY

-

EN